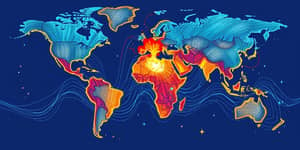

In a world increasingly defined by cross-border exchange, understanding the interwoven nature of national economies has never been more vital. From transcontinental trade routes to digital data flows, the global economic landscape reflects both the promise and perils of connectivity. As trade volumes surge—expanding by over $500 billion in the first half of 2025 alone—and GDP growth navigates shifting currents, nations face a shared journey of opportunity, risk, and collective responsibility.

Consumers benefit from affordable goods sourced globally, while investors chase returns across continents in milliseconds. Yet, this rapid integration also means local disruptions can echo around the world, reminding us that prosperity and vulnerability travel the same highways.

Exploring the dynamics of trade, finance, technology, and policy reveals how national boundaries blur. By examining historical milestones, modern mechanisms, regional pacts, supply chain resilience, and future challenges, we uncover a narrative of interdependence that shapes daily life and global stability.

The Evolution of Global Interconnectedness

Over the past century, advances in transportation, communication, and deregulation have woven markets together at an unprecedented rate. The post-war era saw shipping lines crisscross oceans, while the digital revolution accelerated financial transactions across continents in real time. Today, multinational corporations coordinate production in dozens of countries, capital flows respond to policy shifts within seconds, and consumers enjoy goods from distant shores at affordable prices.

This trajectory has been driven by breakthroughs in digital technology, liberalized trade agreements, and financial innovation. Our modern system thrives on integrated supply chain networks that stretch from raw material extraction to retail shelves, enabling economies of scale and spurring global growth. Yet this same web can transmit shocks—be it a pandemic or a political crisis—with remarkable speed.

Key historical milestones include the establishment of the Bretton Woods institutions in 1944, the oil crises of the 1970s that tested energy interdependence, and the 1990s’ wave of financial liberalization that unleashed cross-border capital surges. Each era reshaped the rules of engagement, setting the stage for today’s complex interplay between sovereign policy and global markets.

Mechanisms of Economic Interaction

Trade remains the cornerstone of economic integration. In 2025, global trade is on track to surpass last year’s record, with a projected $33.3 trillion in total value by year-end. Annual growth rates hover around five percent for goods and six percent for services. Electronics and automotive sectors, particularly hybrid and electric vehicles, lead the charge, while pharmaceuticals and technology services expand rapidly in key markets.

Beyond goods and services, cross-border investment and financial flows have deepened ties. Real-time balance-of-payments tracking reveals how policy shifts—like the United States’ tariff increase to an effective 18.2 percent in mid-2025—can reroute capital, narrow trade imbalances, and reshape global partnerships. China’s share of US imports fell from 22 percent in 2017 to 13.4 percent in 2024, while Mexico emerged as America’s top trading ally.

Consider the US-China-Mexico triangle: as tariffs rose, manufacturers retooled production lines in Mexico to serve US consumers, illustrating both the flexibility and complexity of modern supply chains. Financial markets, exposed to currency movements and policy spillovers, respond almost instantaneously to these shifts, underscoring the fusion of trade and finance.

- Increased efficiency through specialization

- Diversification of revenue streams

- Enhanced growth opportunities abroad

- Systemic risk and financial contagion

- Policy spillover effects

- Heightened vulnerability to shocks

Trade Agreements and Regional Trends

Regional frameworks and bilateral pacts fill the map with new corridors of cooperation. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) underscore contrasting approaches: the former emphasizes high-standard, membership-driven rules, while the latter covers 30 percent of global GDP with broader inclusion.

In Southeast Asia, countries like Vietnam, Thailand, and Indonesia are evolving into critical production hubs. Firms are strategically establishing footprints to capitalize on lower tariffs, skilled labor, and geographic proximity to major markets. At the same time, nations adopt diverse multi-node production hubs to cushion against geopolitical or logistical disruptions.

- CPTPP: shifts in membership and influence

- RCEP: covering thirty percent of global GDP

- Bilateral pacts driving network diversification

Beyond Asia-Pacific, the African Continental Free Trade Area (AfCFTA) and updated EU-Mercosur negotiations illustrate how emerging markets are crafting their own pathways to integration. These agreements promise tariff reductions, streamlined customs procedures, and deeper cooperation on digital trade.

Supply Chains, Resilience, and Risks

The COVID-19 pandemic, natural disasters, and mounting geopolitical tension have revealed the fragility underlying lean supply chains. Companies are recalibrating their models to emphasize resilience alongside efficiency, creating multi-node networks that can reroute production when one link falters.

Advanced technologies, including AI-driven logistics and blockchain tracking, enable real-time visibility and rapid response. Yet these tools introduce new dimensions of complexity and require robust governance. Financial markets, already intertwined, face heightened systemic vulnerabilities across regions if governance lags technological change.

Sectors such as ICT, automotive, pharmaceuticals, and travel services highlight strategic interdependence. A disruption in semiconductor production in East Asia can ripple into automotive output in Europe, while vaccine supply chain delays affect healthcare access worldwide.

Policy Implications and Future Outlook

Policymakers stand at a pivotal crossroads. Decisions about tariffs, investment restrictions, and digital governance will either knit the world closer or accelerate fragmentation. Rising nationalism and uncertainty risk stalling investment, while climate-related shocks demand cooperative solutions.

Governments must strike a balance: safeguarding domestic interests without undermining the rich global economic tapestry that fuels prosperity. Investments in sustainable infrastructure, green energy, and digital frameworks can create shared value and mitigate future risks. Embracing sustainable technological spillover effects ensures that innovation benefits all nations, not just a select few.

- Strengthen multilateral cooperation platforms

- Invest in diversified production hubs

- Support resilient infrastructure development

- Enhance transparency in financial flows

Emerging risks include an estimated $600 billion to $5.7 trillion economic cost of financial fragmentation, and the acute vulnerability of low-income nations dependent on volatile short-term financing. At the same time, AI-driven investment in 2025 has sparked new growth avenues, while improved energy transition scores point to a greener future.

Looking ahead, the interplay of technology, policy, and global collaboration will shape the 21st century’s economic narrative. Nations that foster openness, diversification, and resilience will be better equipped to navigate disruption and seize opportunity. As stakeholders in an interconnected system, we share both responsibility and potential—a reminder that prosperity knows no borders when built on cooperation, innovation, and trust.

References

- https://unctad.org/publication/global-trade-update-october-2025-global-trade-remains-strong-despite-policy-changes-and

- https://www.oecd.org/en/publications/2025/09/oecd-economic-outlook-interim-report-september-2025_ae3d418b/full-report.html

- https://www.oecd.org/en/data/insights/statistical-releases/2025/08/international-trade-statistics-trends-in-second-quarter-2025.html

- https://www.ibisworld.com/blog/2025-economic-drivers/99/1126/

- https://www.bea.gov/news/2025/us-international-trade-goods-and-services-august-2025

- https://www.weforum.org/stories/2025/08/inflection-points-7-global-shifts-defining-2025-so-far-in-charts/

- https://www.goldmansachs.com/insights/articles/the-financial-times-strategic-interdependence-is-rewiring-the-global-economy

- https://dataweb.usitc.gov

- https://desapublications.un.org/publications/world-economic-situation-and-prospects-2025

- https://comtrade.un.org

- https://www.trademap.org/?redirectFromMobile=true

- https://unctad.org/publication/world-economic-situation-and-prospects-2025

- https://www.oxfordeconomics.com/key-themes-2025/