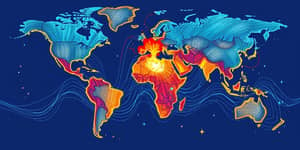

Across the world’s financial stage, nations engage in a covert struggle that reverberates through markets, boardrooms, and households alike. Known as currency wars, these silent conflicts reshape trade balances, influence capital flows, and test the resilience of global cooperation. What appears as routine monetary policy often conceals a silent yet potent influence on economic destinies.

Understanding Currency Wars

Currency wars—sometimes called competitive devaluations—arise when central banks manipulate exchange rates or interest rates to weaken their currencies. By doing so, exporters gain price advantages, imports become costlier, and domestic industries find temporary relief. Unlike open tariffs or trade sanctions, these maneuvers occur behind closed doors in central bank meetings and financial markets.

While subtle, the stakes are enormous. Governments weigh growth stimulation against potential backlash from trading partners, hoping to avoid overt retaliation. Yet, as each side seeks an edge, the race can escalate dangerously, leading to widespread market turbulence.

Historical Precedents

The prototype of currency conflict unfolded during the 1930s Great Depression. Over 70 nations broadly engaged in competitive devaluations, triggering a historic world trade volume collapse of nearly 25% and deepening global hardship. Protectionist tariffs and monetary manipulation fed a vicious cycle that prolonged economic recovery and undermined international goodwill.

Fast forward to 2010–2015: in the aftermath of the global financial crisis, Brazil’s finance minister first invoked the term “currency war,” as the United States, Japan, and China unleashed massive monetary easing programs. These actions, while aimed at domestic revival, sparked fears of beggar-thy-neighbor strategies and volatile capital swings.

Most recently, during 2024–2025, the US dollar’s 13% depreciation against the euro and up to 10% against other majors highlighted how even a reserve currency can become a battleground, with consequences rippling through emerging markets and commodity prices.

Mechanisms and Tools

Governments and central banks deploy several primary instruments to wage currency wars. These tools, in combination or isolation, seek to influence lenders, investors, and traders:

Economic and Financial Impacts

When currencies are pushed artificially low, the immediate winners are export-driven industries. Yet, these gains often come with hidden costs. Domestic consumers face higher import bills, and central banks risk undermining price stability. Emerging economies, dependent on foreign capital, can suffer sudden reversals that spark banking crises.

- Trade distortions and retaliation disrupt supply chains.

- Spurring unpredictable import costs fuels inflation waves.

- Capital flow instability triggers boom-bust cycles.

- Commodity price swings affect global producers and consumers.

Systemic Risks and Unintended Consequences

Competitive devaluations often escalate into a race to the bottom, eroding confidence in national currencies and the broader monetary system. Markets grow fragile under these pressures, especially when algorithmic trading and high-frequency strategies amplify moves in seconds, raising the specter of flash crashes and widespread losses.

Trust, once broken, proves hard to restore. Chronic manipulation breeds suspicion among states, making coordinated responses to crises—such as financial panics or pandemics—ever more difficult.

Geopolitical and Strategic Themes

Two major currents shape today’s strategic landscape. First, growing de-dollarization trends worldwide see countries forging payment systems outside the US dollar, challenging America’s historical dominance. Second, the rise of central bank digital currencies introduces a novel terrain of competition, as nations explore digital tender as tools of influence and control.

These shifts carry profound implications for monetary sovereignty and innovation, as states strive to protect domestic financial stability while jockeying for a larger slice of the global payments ecosystem.

Future Directions and Open Questions

Will ongoing digital currency developments, including CBDCs and private tokens, herald a more stable, transparent system or simply open new fronts in currency conflict? How can international institutions craft frameworks to curb destructive competition while preserving policy flexibility for national emergencies?

Moreover, the growing role of AI and digital innovation in trading and analytics accelerates the pace of these confrontations, leaving regulators scrambling to keep pace with machine-driven dynamics.

Navigating the Turbulent Waters

For businesses and policymakers, awareness is paramount. Firms must factor currency risk into supply chain planning, pricing strategies, and hedging instruments. Governments ought to pursue dialogue through bodies like the IMF and G20 to establish guardrails against the most dangerous escalations.

History teaches that unilateral approaches often backfire. By fostering transparency, data sharing, and mutual accountability, nations can avoid the most destructive outcomes and steer toward a more cooperative monetary environment.

Ultimately, currency wars remind us that the battle for economic dominance unfolds not on battlefields, but in policy decisions, market psychology, and the delicate art of international negotiation. In a world of intertwined economies, lasting success depends less on winning a single skirmish and more on building a robust, resilient global financial order.

References

- https://discoveryalert.com.au/currency-wars-modern-competition-strategies-2025/

- https://www.ecb.europa.eu/press/key/date/2025/html/ecb.sp250930~c973459788.en.html

- https://www.imf.org/en/publications/weo/issues/2025/04/22/world-economic-outlook-april-2025

- https://www.currencytransfer.com/blog/expert-analysis/what-is-a-currency-war

- https://www.dunham.com/FA/Blog/Posts/currency-wars-trade-tariffs-global-risk

- https://www.jpmorgan.com/insights/global-research/currencies/de-dollarization

- https://tnfx.co/what-is-a-currency-war/