Blockchain technology is not just a technological marvel; it is a catalyst for a profound shift in how value moves and how power is distributed. From reshaping entire financial markets to empowering individuals and small businesses, blockchain is driving a new era of transparency and inclusion.

Macro Impact and Market Growth

As financial institutions and regulators grapple with the implications of distributed ledger technology, the economic stakes have never been higher. By 2030, PwC estimates that blockchain could add about USD 1.76 trillion to global GDP through efficiency gains, transparency, trust, and reduced fraud. This projection underscores the urgency for stakeholders to embrace innovation and prepare for staggering shifts in monetary and regulatory frameworks.

The fintech-focused blockchain market itself is surging. Valued at USD 3.4 billion in 2024, it is projected to reach USD 49.2 billion by 2030, reflecting a compound annual growth rate of 55.9%. Meanwhile, the broader blockchain finance market—including payments, trade finance, and digital assets—stood at USD 20.0 billion in 2025 and is expected to soar to USD 376.4 billion by 2035, at a CAGR of 34.1%.

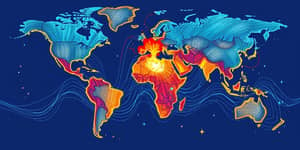

Regional dynamics will further shape this evolution. North America is forecasted to hold 36.4% of the blockchain finance market by 2035, driven by supportive regulation and institutional adoption. In the Asia-Pacific, a projected 25% CAGR will be fueled by digital transformation initiatives, state-backed projects, and vibrant fintech ecosystems.

Core Mechanisms of Decentralization

At its heart, blockchain is about removing or shrinking intermediaries and empowering participants with new tools. Four pillars underpin this transformation:

- Disintermediation: enabling direct, trust-minimized transactions between parties without correspondent banks or clearinghouses.

- Programmability: smart contracts automate complex workflows—from lending to settlements—with minimal manual intervention.

- Transparency and Immutability: an unalterable ledger of transactions reduces fraud and bolsters auditability.

- Tokenization of Value: transforming real-world assets into digital tokens for 24/7 trading, fractional ownership, and on-chain collateral.

Key Use Cases in Global Finance

These foundational capabilities are now materializing in concrete solutions that address some of finance’s most entrenched inefficiencies.

Cross-Border Payments and Remittances

Traditional payment rails can take days to settle, saddling businesses and migrant workers with high fees and opaque processes. Blockchain offers near-instant settlement, often in minutes rather than days.

Stablecoins have emerged as a transformative payment rail. From a circulating supply of roughly USD 5 billion five years ago, stablecoins now exceed USD 305 billion, with USD 32 trillion in transaction volume during 2024. Of that, USD 5.7 trillion represented actual cross-border payments. Industry projections suggest stablecoins could account for 20% of all global remittance flows by 2030.

- Faster settlement times: minutes instead of days.

- 24/7 operation across time zones.

- Lower foreign-exchange and transfer fees.

- Programmable features like escrow and conditional release.

Major players are taking notice. In May 2025, Worldpay partnered with BVNK to enable stablecoin payouts for merchants, unlocking faster, cheaper cross-border transactions and setting a precedent for mainstream adoption.

Decentralized Finance (DeFi)

DeFi protocols now rival traditional banking services across lending, borrowing, derivatives, and asset management. After a slump, DeFi lending volumes bounced back by 30% in early 2025, signaling renewed confidence.

True decentralization is achieved when anyone with a crypto wallet can tap into global capital pools without bank accounts or credit checks. Protocol governance often lies with token holders, distributing decision-making more broadly than corporate boards.

- Access global liquidity without geographical barriers.

- Non-bank lending channels bridge the SME financing gap.

- On-chain collateral and transparent risk models support underbanked borrowers.

Trade Finance and Supply Chain

For centuries, trade finance relied on paper documents, manual checks, and siloed systems. Blockchain’s shared ledger model transforms this landscape by providing a single source of truth for shipping records, inventory data, and financial documents.

In January 2025, IBM launched a blockchain trade finance platform integrating AI and quantum-resistant cryptography. The result: streamlined cross-border settlements, enhanced transparency, and a dramatic reduction in document fraud.

Digital Assets and Tokenization

Tokenization extends beyond cryptocurrencies to bonds, equities, real estate, art, and more. By fractionalizing assets, blockchain opens markets to smaller investors while offering 24/7 trading and global accessibility.

BIS Project Agorá, launched in October 2024, explores tokenizing wholesale central bank money on a shared programmable platform. Early results hint at faster, cheaper international securities transactions and seamless cooperation between central and commercial banks.

Central Bank Digital Currencies and State Power

Central Bank Digital Currencies (CBDCs) represent the next frontier of state-backed digital money. In FTI Consulting’s 2025 survey, 56% of respondents predicted major impacts from CBDCs on banking and finance over the next five years.

Governments are already outlining strategies. The U.S. Treasury’s 2023 National Strategy for Financial Inclusion named distributed ledger technology as a priority for enhancing payment systems’ efficiency, speed, and security.

While CBDCs can recentralize certain controls—granting authorities greater visibility into transactions—they also hold promise for financial inclusion, programmable social benefits, and more resilient payment infrastructures.

Conclusion: An Empowered Financial Future

Blockchain is more than a technology—it is a movement that challenges entrenched power structures and offers a pathway to a more inclusive financial system. From peer-to-peer and programmable money flows to tokenized assets and digital currencies, the waves of change are cascading across markets and institutions.

For businesses, innovators, and policymakers, the message is clear: embrace the decentralized future or risk being left behind. As we venture toward 2035, the promise of blockchain lies in its ability to democratize finance, bridge capital gaps, and foster trust in a global economy that transcends borders. The time to act is now; the potential rewards are profound.

References

- https://www.fintechfutures.com/press-releases/fintech-blockchain-global-industry-report-2025-decentralized-finance-defi-to-bridge-the-huge-sme-financing-gap-to-boost-blockchain-adoption

- https://www.tekrevol.com/blogs/blockchain-statistics-facts/

- https://www.researchnester.com/reports/blockchain-finance-market/8082

- https://bvnk.com/blog/blockchain-cross-border-payments

- https://www.trmlabs.com/reports-and-whitepapers/global-crypto-policy-review-outlook-2025-26

- https://www.imf.org/en/blogs/articles/2025/09/04/how-stablecoins-and-other-financial-innovations-may-reshape-the-global-economy

- https://www.ftitechnology.com/spotlight/the-state-of-blockchain