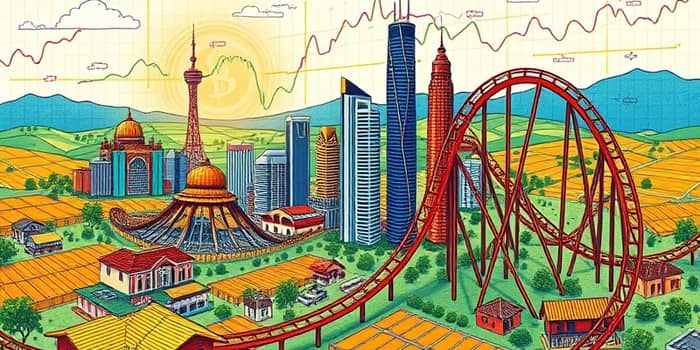

Emerging markets occupy a pivotal place in the global economy, promising both remarkable expansion and daunting uncertainty.

In 2025, these economies will account for over half of the world’s GDP, sparking debate on whether they truly serve as global growth catalysts or if they conceal pitfalls beneath their rising figures.

Defining Emerging Markets: The Middle Ground

Emerging markets are neither fully developed nor low-income; they represent a transition zone characterized by characteristics between developing and developed nations.

Their per capita income typically sits between 10% and 75% of the EU average, with rapid industrialization, financial market growth, and integration into international trade.

Examples range from giants like China, India, and Brazil to fast-growing economies such as Vietnam, the Philippines, and Kenya.

The Growth Engine Argument

IMF forecasts predict that emerging and developing economies will grow by 4.2% in 2025, nearly triple the 1.6% growth projected for advanced markets.

Collectively, EMs will contribute 66.4% of global GDP growth over the decade, underpinned by robust investment and consumer demand.

A youthful demographic structure and expanding middle class have created burgeoning domestic markets.

Urbanization and rising incomes drive consumption in sectors like retail, technology, and financial services, painting a picture of rapid industrialization and widening consumer base.

- Young, urbanizing populations fueling labor force growth.

- Digital leapfrogging via smartphones, e-commerce, and fintech adoption.

- Policy reforms and market liberalization attracting foreign direct investment.

- Infrastructure projects boosting productivity and regional connectivity.

The Volatility Trap Perspective

Despite growth credentials, emerging markets often display pronounced market swings and political instability that challenge investors.

Inflation remains above target in many countries—averaging 5% in 2025—and double digits in places like Turkey and Ghana.

Currency depreciation and sharp capital outflows during global risk-off episodes can quickly erode returns.

Geopolitical tensions, notably between the US and China, introduce supply-chain disruptions and tariff unpredictability.

- High inflation and erratic central bank responses.

- Exchange rate volatility affecting corporate earnings.

- Dependence on commodity exports making some economies vulnerable.

- Political uncertainty and governance weaknesses undermining investor confidence.

2025 Outlook and Structural Trends

As we move into 2025, advanced and emerging markets diverge on growth, inflation, and risk exposures.

This snapshot highlights the differentiated performance across emerging landscapes, from India’s 6.5% growth to Brazil’s more modest 2.4%.

Looking forward, several structural trends will shape EM trajectories:

- Digital inclusion and fintech advances driving financial access.

- Environmental, social, and governance (ESG) initiatives steering sustainable investment.

- Divergence between commodity-reliant and technology-driven economies.

Moreover, policy flexibility remains a crucial buffer: China’s $70 billion stimulus in early 2025 underscores many EM authorities’ readiness to deploy fiscal measures when needed.

Balancing Opportunity and Risk

No single narrative fully captures the essence of emerging markets.

They are simultaneously engines of growth—powered by demographics, consumption, and digital innovation—and potential volatility traps, sensitive to policy shifts, global shocks, and institutional fragilities.

Investors and policymakers must navigate these dualities, emphasizing both the resilient domestic demand and policy flexibility that underpin surge potential and the structural reforms needed to mitigate spikes in volatility.

Ultimately, emerging markets in 2025 embody both promise and peril. Recognizing their multifaceted nature is essential to unlocking long-term gains while managing inevitable downturns.

References

- https://us.plus500.com/newsandmarketinsights/defining-emerging-markets

- https://www.triodos-im.com/articles/2025/emerging-markets-mid-year-2025-investment-outlook

- https://www.etftrends.com/etf-strategist-channel/new-emerging-markets/

- https://www.temit.co.uk/resources/growth

- https://www.smartling.com/blog/emerging-markets

- https://www.worldeconomics.com/Regions/Emerging-Markets/

- https://en.wikipedia.org/wiki/Emerging_market

- https://www.imf.org/external/datamapper/index.php

- https://corporatefinanceinstitute.com/resources/economics/emerging-markets/

- https://www.fuqua.duke.edu/programs/executive-education/leading-global-business-strategy/emerging-market-outlook

- https://hellopebl.com/resources/blog/top-emerging-markets/

- https://www.imf.org/en/publications/weo/issues/2025/10/14/world-economic-outlook-october-2025

- https://www.pinebridge.com/en/insights/2025-emerging-market-fixed-income-outlook

- https://institutional.fidelity.com/advisors/insights/topics/investing-ideas/why-2025-might-be-the-year-for-emerging-markets

- https://www.oecd.org/en/publications/2025/09/oecd-economic-outlook-interim-report-september-2025_ae3d418b/full-report.html

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/on-the-minds-of-investors/can-emerging-markets-equities-outshine-developed-markets-in-2025/

- https://www.jpmorgan.com/insights/global-research/outlook/mid-year-outlook