Imagine having a financial blueprint that not only grows your wealth but does so with a clear, calculated approach to managing uncertainty.

Modern Portfolio Theory (MPT), developed by economist Harry Markowitz in 1952, offers exactly that—a Nobel Prize-winning strategy that has reshaped how investors think about building their futures.

By focusing on the relationships between assets rather than picking individual winners, MPT helps you construct portfolios that maximize expected returns for a given level of risk.

This isn't just about chasing high gains; it's about crafting a sustainable path to financial security that aligns with your personal goals and comfort zone.

Whether you're a seasoned investor or just starting out, understanding MPT can transform your approach from guesswork to a disciplined, data-driven journey.

The Birth of a Financial Revolution

Harry Markowitz introduced MPT at a time when investment strategies were largely based on intuition and individual stock performance.

His work earned a Nobel Prize because it shifted the focus to portfolio-level optimization, emphasizing that diversification is key to reducing volatility.

This framework laid the groundwork for modern investment practices, influencing everything from mutual funds to robo-advisors like M1 Finance.

At its core, MPT is built on the idea that you can achieve better outcomes by spreading your investments across different asset classes.

This historical context reminds us that smart investing isn't about luck; it's about applying proven principles to navigate market complexities.

Core Principles That Shape Your Portfolio

MPT rests on several foundational principles that guide every decision you make in your investment journey.

- Risk-Return Tradeoff: Higher potential returns always come with higher risk; MPT helps you find the sweet spot based on your personal risk tolerance.

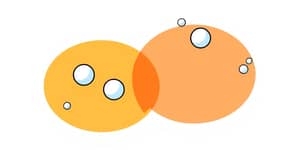

- Diversification: By spreading investments across assets like stocks, bonds, and alternatives, you minimize the impact of any single market event.

- Asset Correlation: Assets with low or negative correlations, such as stocks and bonds, can offset losses during downturns.

- Systematic vs. Unsystematic Risk: Diversification reduces unsystematic risk, but systematic risk, tied to the overall market, remains unavoidable.

- Mean-Variance Optimization (MVO): This mathematical process allocates portfolio weights to maximize returns for your chosen risk level.

Embracing these principles means moving beyond impulsive choices to a structured strategy that protects and grows your wealth over time.

Visualizing Success: The Efficient Frontier and Tools

One of MPT's most powerful tools is the Efficient Frontier, a graph that plots portfolios by their expected return versus risk.

Portfolios on the upper curve offer the maximum return for each level of risk, while those below are considered suboptimal and inefficient.

Another key concept is the Capital Allocation Line (CAL), which connects a risk-free asset to the optimal risky portfolio on the frontier.

The slope of this line represents the Sharpe ratio, a measure of reward per unit of risk, helping you identify the best investment mix.

To apply these tools in practice, start by assessing your own financial goals, time horizon, and comfort with volatility.

This table illustrates how different assets contribute to a balanced portfolio, highlighting the importance of mixing growth-oriented and stable investments.

The Math Behind the Magic

MPT uses mathematical formulas to quantify risk and return, making investment decisions more precise and less emotional.

- Expected Return is calculated as the weighted average of individual asset returns.

- Portfolio Variance measures risk, incorporating covariance terms that show how assets move together.

- The Sharpe Ratio evaluates portfolio efficiency by comparing excess return to risk.

While these calculations might seem complex, they empower you to make informed choices rather than relying on gut feelings.

For example, by understanding variance, you can see how diversification literally reduces the mathematical risk in your portfolio.

Putting Theory into Practice

Implementing MPT involves actionable steps that you can start today to optimize your investment mix.

- Assess your risk tolerance and financial goals to determine your ideal asset allocation.

- Diversify within asset classes by including different sectors and geographies.

- Rebalance your portfolio periodically to maintain target weights and adapt to market changes.

- Minimize fees and taxes to enhance net returns over the long term.

- Consider advanced strategies like leverage or incorporating alternatives for added protection.

MPT contrasts with other investment styles, such as value or growth investing, by prioritizing overall portfolio health over individual stock picks.

- Value Investing focuses on undervalued stocks, while MPT emphasizes risk-adjusted returns.

- Growth Investing chases high-growth stocks, whereas MPT balances growth with stability.

- Momentum strategies follow market trends, but MPT uses diversification to mitigate trend risks.

By following these steps, you can build a portfolio that not only aims for growth but also withstands market fluctuations with resilience.

Navigating the Limitations

Despite its strengths, MPT has criticisms that are important to acknowledge for a realistic investment approach.

- It assumes stable correlations and normal return distributions, which can break down during financial crises.

- The model is sensitive to input estimates, meaning small errors in data can lead to suboptimal allocations.

- Real-world factors like taxes and transaction costs are often ignored in the theoretical framework.

However, these limitations don't invalidate MPT; instead, they remind us to use it as a flexible guide rather than a rigid rulebook.

Adapting the theory to your unique circumstances—such as adjusting for economic cycles or personal liquidity needs—can enhance its effectiveness.

Your Personal Path to Portfolio Optimization

MPT isn't just for institutional investors; it's a practical tool for anyone looking to secure their financial future with confidence.

Start by defining your risk profile: aggressive investors might lean more towards equities, while conservative ones could prioritize bonds.

Use historical examples, like offsetting risks between crude oil and airline stocks, to inspire your own diversification strategies.

Remember, the goal is to create a portfolio that aligns with your life goals, whether that's saving for retirement, funding education, or achieving financial independence.

By embracing MPT, you're not just investing; you're crafting a legacy of smart, sustainable wealth that can weather any storm.

Take the first step today by reviewing your current investments and considering how diversification can reduce your risk without sacrificing returns.

References

- https://www.fe.training/free-resources/financial-markets/modern-portfolio-theory/

- https://ironwoodwm.com/portfolio-strategies-rooted-in-modern-portfolio-theory/

- https://m1.com/knowledge-bank/modern-portfolio-theory-mpt-your-guide-to-smarter-investing/

- https://www.ortecfinance.com/en/insights/blog/advancements-in-modern-portfolio-theory

- https://alphaarchitect.com/can-modern-portfolio-theory-still-teach-us-any-lessons-today/

- https://www.range.com/blog/modern-portfolio-theory-explained-a-guide-for-investors

- https://investor.vanguard.com/investor-resources-education/education/model-portfolio-allocation

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/modern-portfolio-theory-mpt/

- https://equitymultiple.com/glossary/strategic-asset-allocation

- https://en.wikipedia.org/wiki/Modern_portfolio_theory

- https://www.cqf.com/blog/quant-finance-101/what-is-modern-portfolio-theory

- https://equitymultiple.com/blog/modern-portfolio-theory