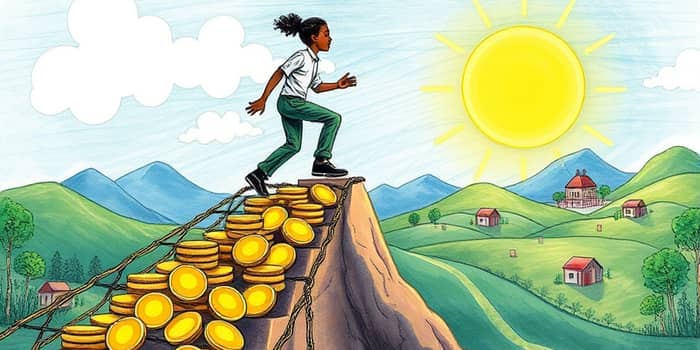

In an era of economic volatility, financial resilience has become a cornerstone of personal security and well-being.

It empowers individuals to face unexpected challenges without derailing their dreams or health.

This article will guide you through actionable steps to create robust financial buffers, transforming anxiety into confidence.

Financial resilience is more than just saving money; it's about cultivating a mindset and systems that protect you during crises.

From sudden job loss to medical emergencies, those with strategic reserves in place can navigate disruptions with grace and recovery speed.

By building these buffers, you not only safeguard your finances but also enhance your overall life satisfaction and mental health.

Understanding Financial Resilience

At its core, financial resilience is defined as the capacity to anticipate, withstand, and recover from financial shocks.

This includes events like economic downturns or personal emergencies that can strain resources.

It differs from financial fragility, where minor setbacks lead to severe consequences such as debt or poverty due to limited buffers.

Key elements involve structural components like savings and insurance, adaptive strategies such as budgeting, and positive outcomes like improved stability.

Embracing this concept means moving from a reactive to a proactive approach in managing your finances.

Key Components of Financial Resilience

The foundation of financial resilience is built on several interdependent components that work together to create a safety net.

- Economic resources including stable income and manageable debt levels act as essential buffers against shocks.

- Financial literacy and behavior enable informed decisions, such as building emergency funds and avoiding high-interest loans.

- Social capital from family and community networks provides crucial support during tough times.

- Access to financial services, like banking and insurance, is vital for risk mitigation and growth.

These elements are not isolated; they reinforce each other to build a holistic defense system.

For instance, financial knowledge helps optimize the use of economic resources and social connections.

Strategies for Building Your Financial Buffers

Practical steps can help you create resilience reserves that protect against unforeseen events.

- Emergency funds covering 3-6 months of expenses are a benchmark for liquidity and security.

- Savings habits, such as automated contributions, increase your preparedness over time.

- Debt management involves reducing high-interest loans and borrowing responsibly to maintain flexibility.

- Income diversification through side businesses or multiple streams solidifies your revenue base.

Additionally, cost-cutting and budgeting ensure that spending aligns with your financial goals.

Investing after basics are covered allows wealth to grow through compounding, enhancing long-term resilience.

Insurance and risk transfer mechanisms protect against quantifiable risks, providing a safety net for major shocks.

This table summarizes key targets to aim for in your resilience journey.

Measuring Your Financial Resilience

Indicators of resilience help you assess your progress and identify areas for improvement.

- Having 3-6 months of expenses in emergency savings is a critical marker of preparedness.

- A high savings rate relative to income demonstrates consistent financial discipline.

- The ability to manage spending and handle debt without stress shows adaptive capacity.

- Covering unexpected expenses within a short timeframe, like the $2,000 test, reduces fragility risks.

Regularly evaluating these metrics can keep you on track and motivated to build stronger buffers.

Benefits of Financial Resilience

Achieving financial resilience yields tangible benefits that extend beyond money.

- Reduced financial fragility and debt stress lead to lower poverty risk and better crisis handling.

- Improved life satisfaction and well-being are linked to lower stress levels and higher mental health.

- Enhanced stability provides long-term security, reducing vulnerability to economic shocks.

- For institutions, fostering customer resilience can increase loyalty and revenue, as shown in studies.

These outcomes create a ripple effect, contributing to community stability and broader economic security.

Real-World Examples and Challenges

Learning from real-life contexts can inspire and inform your resilience-building efforts.

During the COVID-19 pandemic, households with robust savings and social networks managed impacts more effectively.

However, disparities exist, especially for low-income or marginalized groups facing structural barriers like limited banking access.

This underscores the need for targeted interventions and inclusive strategies to bridge gaps.

Financial resilience also supports sustainability goals by preventing instability from derailing progress on issues like climate change.

At a systemic level, banks with higher capital buffers have demonstrated stronger support during crises.

Overcoming Challenges in Building Resilience

Common obstacles can be addressed with persistence and smart planning.

- Behavioral gaps, such as procrastination, can be countered with automated savings and goal-setting tools.

- Structural barriers require advocating for better access to financial services and education.

- Vulnerabilities in specific populations highlight the importance of community support and policy changes.

By acknowledging these challenges, you can develop more resilient strategies that adapt to your unique circumstances.

Financial resilience is not a destination but an ongoing journey of growth and protection.

Start small, focus on one buffer at a time, and celebrate milestones to stay motivated.

With dedication and the right tools, you can build a financial fortress that withstands life's storms and secures your future.

References

- https://pmc.ncbi.nlm.nih.gov/articles/PMC12403627/

- https://www.hansfordbell.co.uk/what-is-financial-resilience/

- https://pollution.sustainability-directory.com/term/financial-resilience/

- https://fintechtakes.com/articles/2025-08-28/building-financial-resiliency/

- https://personetics.com/importance-of-financial-resilience/

- https://www.clevelandfed.org/collections/speeches/2024/sp-20240229-building-financial-system-resilience

- https://www.breadfinancial.com/en/financial-education/responsible-saving/building-financial-resilience.html