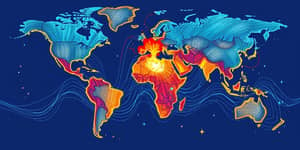

As the global economic landscape shifts dramatically in 2025, the familiar contours of U.S.-led unipolarity are giving way to a more complex, multipolar reality. Economic nationalism is rising, trade networks are fragmenting, and new engines of growth are emerging in Asia, Africa, and Latin America. This article examines the major drivers, regional dynamics, and future pathways in this transformative era.

Major Drivers of the New Economic Power Balance

Geopolitical tensions and protectionist policies have reshaped global trade. In mid-2025, the U.S. average effective tariff rate hit 18.2%, a level unseen since 1934. In response, partners like China have diversified export destinations beyond traditional markets, boosting shipments to Europe by 6% and to North American neighbors by 25%.

Meanwhile, global growth forecasts have slid to between 2.3% and 3.2% in 2025, down from 3.3% in 2024. Advanced economies are expected to grow at 1.5%–2%, while emerging markets maintain 3.5%–4% expansion, with India leading the pack.

Technological innovation and the energy transition further redefine competitiveness. Rapid AI adoption disrupts labor markets, and renewables now enjoy renewable energy cost parity, with solar 41% and wind 53% cheaper than fossil alternatives. In 2024, 92.5% of new global electricity capacity was renewable. China’s clean-energy sector accounts for 10% of its GDP, matching 2020’s total solar output in just Q1 2025.

Regional Economic Power Shares

North America, Europe, and China: Changing Roles

The United States remains a technological leader, but its growth has stabilized near 2%. With America First protectionist measures provoking global retaliation, supply chains are being rewired towards friendly partners.

Europe is staging a strategic repivot through massive fiscal expansion, especially in Germany. Investments in infrastructure, defense, and digital technologies aim to narrow the growth gap with the U.S., even as core eurozone economies forecast sluggish 0.5%–1% expansion.

China continues to outpace rivals in manufacturing and clean technology, redirecting trade away from the U.S. towards Europe and emerging markets. Yet it faces headwinds from deleveraging efforts, weak household consumption, and the risk of overcapacity-induced deflation.

Global South and Emerging Markets

Emerging economies are forging new growth paths. India’s robust expansion underpins global prospects, while South-South trade is set to exceed 33% of global commerce by 2025. However, high external debt leaves many vulnerable to rising U.S. interest rates and costlier imports.

- India’s 6%–7% growth anchors global demand.

- South-South trade relations expansion fosters regional interdependence.

- Debt-servicing pressures necessitate rebuilding fiscal buffers.

- Opportunities in digital infrastructure and agritech are rising.

Economic Fragmentation and Risks

The postwar economic order is yielding to a multipolar global economic order where power is more broadly distributed. Nations pursue “friendshoring” of supply chains, erecting regional blocs that could cost the global economy between $0.6 and $5.7 trillion.

- Escalating trade wars risk further growth slowdowns.

- Financial tightening threatens low-income, commodity-exporting states.

- Policy uncertainty amplifies volatility in commodity markets.

- Fragmentation may undercut decades of trade liberalization.

Energy and Sustainability Transitions

Renewable deployment is accelerating at an unprecedented pace. Nearly three-quarters of new electricity capacity in 2024 was renewable, reshaping investment flows and infrastructure priorities. Nations that master clean technology stand to gain strategic advantage in this era.

China’s leading role in solar panel manufacturing and wind turbine production underscores the strategic dimension of the energy transition. Yet surging domestic energy demand challenges the pace of decarbonization and underscores the need for innovation in storage and grid resilience.

The Path Forward: Opportunities and Adaptation

Adapting to this new landscape requires nimble policies and forward-looking investments. Three critical areas stand out:

- digital literacy and AI upskilling to prepare workforces for technological change.

- fiscal innovation and social resilience to support aging populations and mobile labor.

- Rebuilding multilateral frameworks to balance bilateral dynamics.

Building resilience will involve not only economic diversification but also stronger cooperation on climate, health, and finance. The risk of fragmentation must be countered by renewed commitments to shared prosperity and open innovation.

Conclusion: Navigating a New World Order

We stand at a crossroads between competitive fragmentation and collaborative renewal. The choices policymakers, businesses, and communities make today will determine whether the emerging multipolar order fosters sustainable growth or entrenches divisions.

By investing in clean energy, digital skills, and inclusive institutions, the global community can chart a course towards a more balanced, resilient, and interconnected world economy. The Great Economic Power Rebalance is both a challenge and an opportunity — one that demands vision, cooperation, and the courage to adapt.

References

- https://www.weforum.org/stories/2025/08/inflection-points-7-global-shifts-defining-2025-so-far-in-charts/

- https://active.williamblair.com/global-equity/alexa-davis/2025s-global-power-shift/

- https://rsmus.com/insights/economics/global-economic-outlook-for-2025.html

- https://www.caixabankresearch.com/en/economics-markets/activity-growth/world-economy-2026-resilience-transition-or-disruption

- https://www.oecd.org/en/publications/2025/09/oecd-economic-outlook-interim-report-september-2025_ae3d418b/full-report.html

- https://www.imf.org/en/publications/weo/issues/2025/04/22/world-economic-outlook-april-2025

- https://www.imf.org/en/publications/weo/issues/2025/10/14/world-economic-outlook-october-2025

- https://www.futureagenda.org/foresights/shifting-power-and-influence/

- https://www.brookings.edu/articles/april-2025-update-to-tiger-the-world-economy-shudders-and-could-stall/

- https://www.voronoiapp.com/economy/A-Visual-Breakdown-of-Where-Economic-Power-Lies-in-2025-4715

- https://www.alliancebernstein.com/us/en-us/investments/insights/economic-perspectives/world-economy-to-continue-rebalancing-in-2025.html

- https://statisticstimes.com/economy/projected-world-gdp-ranking.php

- https://www.oxfordeconomics.com/resource/shifting-economic-gravity-in-a-global-rebalance/

- https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/economic-conditions-outlook

- https://www.jpmorgan.com/insights/markets-and-economy/top-market-takeaways/tmt-in-the-rear-view-how-did-our-2025-themes-pan-out