In the world of investing, success isn't just about how much money you make; it's about how much risk you take to get there. The Sharpe ratio offers a powerful lens to view this balance, transforming complex financial decisions into clear, actionable insights. By measuring risk-adjusted performance, it empowers you to see beyond raw returns and understand the true cost of your investments. This tool isn't just for Wall Street experts; it's a beacon for anyone seeking to navigate markets with confidence and clarity.

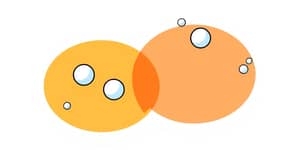

Imagine you have two investment options: one that yields high returns with wild swings, and another with modest gains but steady growth. Which one is truly better? The Sharpe ratio answers this by quantifying the excess return per unit of volatility, helping you compare apples to apples. Developed over half a century ago, it has become a cornerstone of modern finance, yet its simplicity belies a depth that can unlock smarter portfolio choices. Whether you're a seasoned trader or a novice investor, mastering this metric can elevate your strategy from guesswork to guided precision.

At its core, the Sharpe ratio bridges the gap between ambition and prudence, reminding us that not all returns are created equal. It starts with a basic premise: investors deserve compensation for taking on risk beyond a safe harbor like U.S. Treasury securities. By calculating how much extra reward you earn for each bump in the road, it aligns with fundamental valuation theory, making it an indispensable part of any financial toolkit. In this article, we'll dive deep into its history, formula, applications, and even its flaws, arming you with practical knowledge to enhance your investment journey.

The Genesis: A Nobel Insight

The Sharpe ratio traces its roots to 1966, when economist William F. Sharpe introduced it as a way to evaluate mutual funds. Sharpe, who later won the Nobel Prize in Economics, envisioned a metric that could cut through the noise of market hype. His innovation was to standardize performance by accounting for volatility, creating what he called the reward-to-variability ratio. This wasn't just a mathematical exercise; it was a paradigm shift that democratized risk assessment, allowing everyday investors to make more informed decisions.

Over time, the ratio evolved, with Sharpe refining it in 1994 to use benchmarks instead of a fixed risk-free rate. This ex-ante version, defined as \( S_a = \frac{E[R_a - R_b]}{\sigma_a} \), made it more adaptable to real-world scenarios. By focusing on expected values, it became a forward-looking tool, not just a historical snapshot. Today, it's widely used in contexts from portfolio management to algorithmic trading, proving that great ideas often start simple and grow to meet complex challenges.

Demystifying the Formula

The Sharpe ratio might seem intimidating, but its formula is elegantly straightforward: \( \text{Sharpe Ratio} = \frac{R_p - R_f}{\sigma_p} \). Here, \( R_p \) represents the expected portfolio return, \( R_f \) is the risk-free rate, and \( \sigma_p \) is the standard deviation of portfolio returns, acting as a proxy for volatility. To calculate it, you follow two simple steps that anyone can apply with basic financial data.

- First, subtract the risk-free rate from your portfolio return to find the excess return.

- Then, divide this excess return by the standard deviation to get the ratio.

This process highlights the importance of volatility management, as lower standard deviations can boost the ratio even with moderate returns. For daily calculations, such as in active trading, you might use average daily returns and standard deviations, adjusting for market closures. Remember, the ratio assumes normal distributions, but in practice, it's often used with caveats for non-normal scenarios like options trading.

Real-World Examples: Putting Numbers to Work

Let's bring the Sharpe ratio to life with concrete examples. Suppose a portfolio has an expected return of 10%, a risk-free rate of 2.5%, and a standard deviation of 6%. Plugging into the formula gives \( (10\% - 2.5\%) / 6\% = 1.25 \), indicating a solid risk-adjusted performance. In another case, with a 15% excess return and 10% volatility, the ratio is 1.5, showcasing even better efficiency.

- Portfolio return 12%, risk-free rate 5%, volatility 10%: Sharpe ratio = 0.7.

- 12-month return 15%, risk-free rate 3%, volatility 8%: Sharpe ratio = 1.5.

These illustrations demonstrate how the ratio varies with market conditions, helping you gauge whether a high return justifies its risks. It's crucial to note that a ratio above 1.0 is generally acceptable, while above 3.0 is exceptional, but context matters—what's good for a mutual fund might differ for a hedge fund. By practicing with such numbers, you can develop an intuitive sense for balancing risk and reward in your own investments.

What Makes a "Good" Sharpe Ratio?

Benchmarking the Sharpe ratio provides a quick sanity check for your investments. Industry standards often categorize ratios to guide decision-making, but they're not absolute rules.

- Below 1.0: Considered sub-par, indicating that risks may not be adequately compensated.

- Above 1.0: Acceptable, showing a decent trade-off between return and volatility.

- Above 2.0: Strong, suggesting efficient risk management and potential for outperformance.

- Above 3.0: Exceptional, rare in practice and often signaling superior strategy or luck.

Higher ratios are always preferred, as they mean you're getting more bang for your buck in terms of risk. However, a negative ratio warns that volatility is eroding returns, prompting a reevaluation. Use these benchmarks as a starting point, but always pair them with qualitative analysis to avoid overreliance on numbers alone.

The Investor's Toolkit: Practical Applications

The Sharpe ratio shines in diverse financial contexts, from comparing mutual funds to optimizing personal portfolios. Its applications are vast, empowering you to make rational choices in a chaotic market.

- Portfolio Comparison: Evaluate different investments on a level playing field by adjusting for risk.

- Diversification Strategies: Improve your ratio by adding assets that reduce overall volatility.

- Trading Decisions: Use daily calculations to fine-tune active strategies and hedge risks.

By focusing on risk-adjusted metrics, you can avoid the trap of chasing high returns without considering the downsides. For instance, a fund with a Sharpe ratio of 2.0 might be a safer bet than one with higher returns but a ratio of 0.5, as it indicates better consistency. Incorporate this into your regular reviews to build a resilient, growth-oriented portfolio over time.

The Flip Side: Criticisms and Limitations

While the Sharpe ratio is a valuable tool, it's not without flaws. Critics point out several limitations that can distort its effectiveness, especially in turbulent markets. Understanding these weaknesses is key to using it wisely and complementing it with other metrics.

These criticisms underscore the need for a balanced approach. As Jack Bogle noted, the Sharpe ratio has limitations in evaluating mutual funds, so it's best used as part of a broader analysis. By acknowledging its constraints, you can avoid overconfidence and make more robust investment decisions.

Beyond Sharpe: Complementary Metrics

To overcome the Sharpe ratio's shortcomings, savvy investors turn to alternative metrics that offer different perspectives on risk and return. Combining these can provide a fuller picture of your portfolio's health.

- Sortino Ratio: Focuses only on downside volatility, making it better for assessing losses.

- CVAR (Conditional Value at Risk): Measures potential losses in worst-case scenarios, ideal for options or tail risk.

- Largest Loss: A direct, simple metric to gauge maximum drawdowns and recovery potential.

Integrating these tools with the Sharpe ratio allows you to tailor your risk assessment to specific strategies, such as hedge funds or retirement savings. For example, use the Sortino ratio if you're more concerned about crashes, or CVAR for complex derivatives. This holistic toolkit ensures you're not blinded by a single number, fostering a more nuanced and resilient investment philosophy.

Mastering Risk: A Holistic Approach

Embracing the Sharpe ratio is about more than crunching numbers; it's about cultivating a mindset that values efficiency and sustainability in investing. Start by calculating it for your current holdings to identify areas for improvement, such as reducing volatility through diversification. Regularly update your ratios as markets evolve, and don't hesitate to experiment with different benchmarks or time horizons.

Pair quantitative analysis with qualitative insights, like understanding economic cycles or liquidity risks, to avoid common pitfalls. Remember, the goal isn't to chase the highest ratio blindly, but to achieve a balance that aligns with your financial goals and risk tolerance. By mastering this metric, you join a community of informed investors who navigate uncertainty with poise, turning risk from a foe into an ally on the path to wealth creation.

References

- https://www.wallstreetprep.com/knowledge/sharpe-ratio/

- https://www.tastylive.com/shows/options-jive/episodes/why-the-sharpe-ratio-is-not-a-good-measure-of-risk-for-options-08-20-2024

- https://en.wikipedia.org/wiki/Sharpe_ratio

- https://www.rcmalternatives.com/2015/04/sharpe-ratio-the-black-sheep-of-risk-analysis/

- https://www.schwab.com/learn/story/calculate-sharpe-ratio-to-gauge-risk

- https://www.cmcmarkets.com/en-gb/fundamental-analysis/what-is-the-sharpe-ratio

- https://www.businessinsider.com/personal-finance/investing/sharpe-ratio

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/risk-management/sharpe-ratio-definition-formula/

- https://portfoliopilot.com/portfolio-management/resources/the-hidden-flaw-in-risk-adjusted-returns-why-sharpe-ratio-fails-in-real-world-investing

- https://www.stocktrak.com/faq/sharpe-ratio-calculated/

- https://www.britannica.com/money/sharpe-ratio-overview

- https://www.youtube.com/watch?v=9HD6xo2iO1g

- https://www.trustnet.com/investing/13426331/common-misconceptions-about-the-sharpe-ratio-debunked